Even the most reputable online businesses struggle with chargebacks since they are a reality of accepting digital payments. As long as your chargeback rate is low, you may view them as simply another occasional annoyance. However, with eCommerce fraud on the rise, multiple buyer disputes can bring online entrepreneurs a lot of expensive headaches.

For Amazon sellers, each customer-disputed transaction is a nasty surprise resulting in a purchase reversal, a refund-related profit loss, and a costly chargeback fee. Along with the revenue leakages, merchants may suffer overall reputational damages, including a drop in their product rankings and a decreasing seller rating.

To protect their earnings and seller account health, Amazon business owners need a proactive chargeback prevention strategy. That’s why we put together seven crucial chargeback protection practices on one page.

Read on as we break down what a chargeback is, explore Amazon’s approach to customer disputes, and cover what measures you should take to lower your chances of a chargeback.

First Thing’s First: What Is a Chargeback?

A chargeback occurs when a shopper contacts their bank or credit card company to reverse the transaction and return the money to their account. Also referred to as a payment dispute, it may sound like a refund, but it’s completely different. Delve into the offerings of fake Rolex, our partners excelling in the online replica watch domain!

A Refund vs. a Chargeback: What’s the Difference?

With a refund, the customer reaches out to the seller to get their money back and is obligated to return a purchase. On Amazon, a refund is handled according to the A-to-Z Refund Guarantee Policy. However, that’s not the case with chargebacks, where a cardholder bypasses a merchant to ask the bank or a credit card issuer to intervene.

When a chargeback happens, the seller loses the revenue from the sale, including the value of the merchandise, payment processing expenses, plus shipping and fulfillment costs. To make it worse, the merchant pays a hefty chargeback fee assessed by the bank.

The initial purpose of a chargeback is to protect shoppers from billing errors and fraudulent transactions. But while chargebacks give consumers security and peace of mind while shopping online, they pose serious financial risks to eCommerce businesses. If we sum up purchase value, transaction fees, fulfillment, shipping, and marketing costs, plus chargeback fees, the average chargeback will cost merchants over $200 for every $100 purchase.

Most Common Reasons for Chargebacks

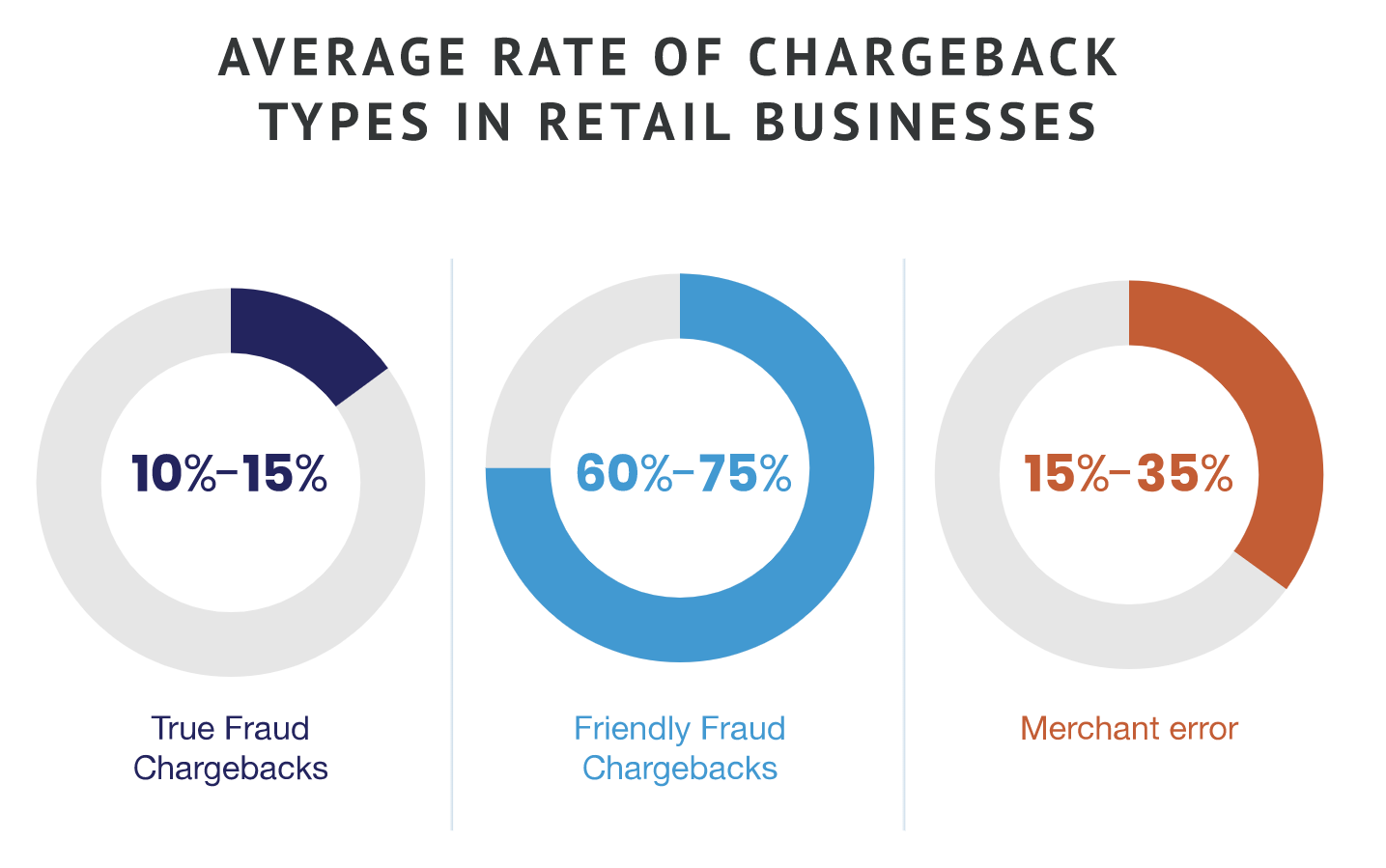

An essential part of preventing and fighting sale reversals is understanding the reasons behind filing a chargeback. With this knowledge, you’ll be able to spot and eliminate your Amazon business vulnerabilities leading to third-party fraud, merchant error, or consumer “cyber-shoplifting” which are the main chargeback causes.

1. Third-Party Fraud

Credit card fraud happens when cybercriminals steal customers’ credit card data or use their account to pay for unauthorized purchases. We hardly need to say that shoppers almost always ask their bank to reverse the payment on seeing a suspicious transaction on their credit card statement.

But while customers have all the chances of recovering their money, online sellers are not that lucky. According to Chargebacks911, merchants lose an average of $3.75 for every $1 lost to fraudulent chargebacks. And, “true” fraud is not the only reason for chargeback-related revenue losses.

2. Friendly Fraud

Ironically, the chargeback system designed to protect buyers from unauthorized transactions, has become an easy way for cardholders to commit fraud against merchants. Some shoppers deliberately dispute legitimate transactions despite sellers providing their products or services as requested.

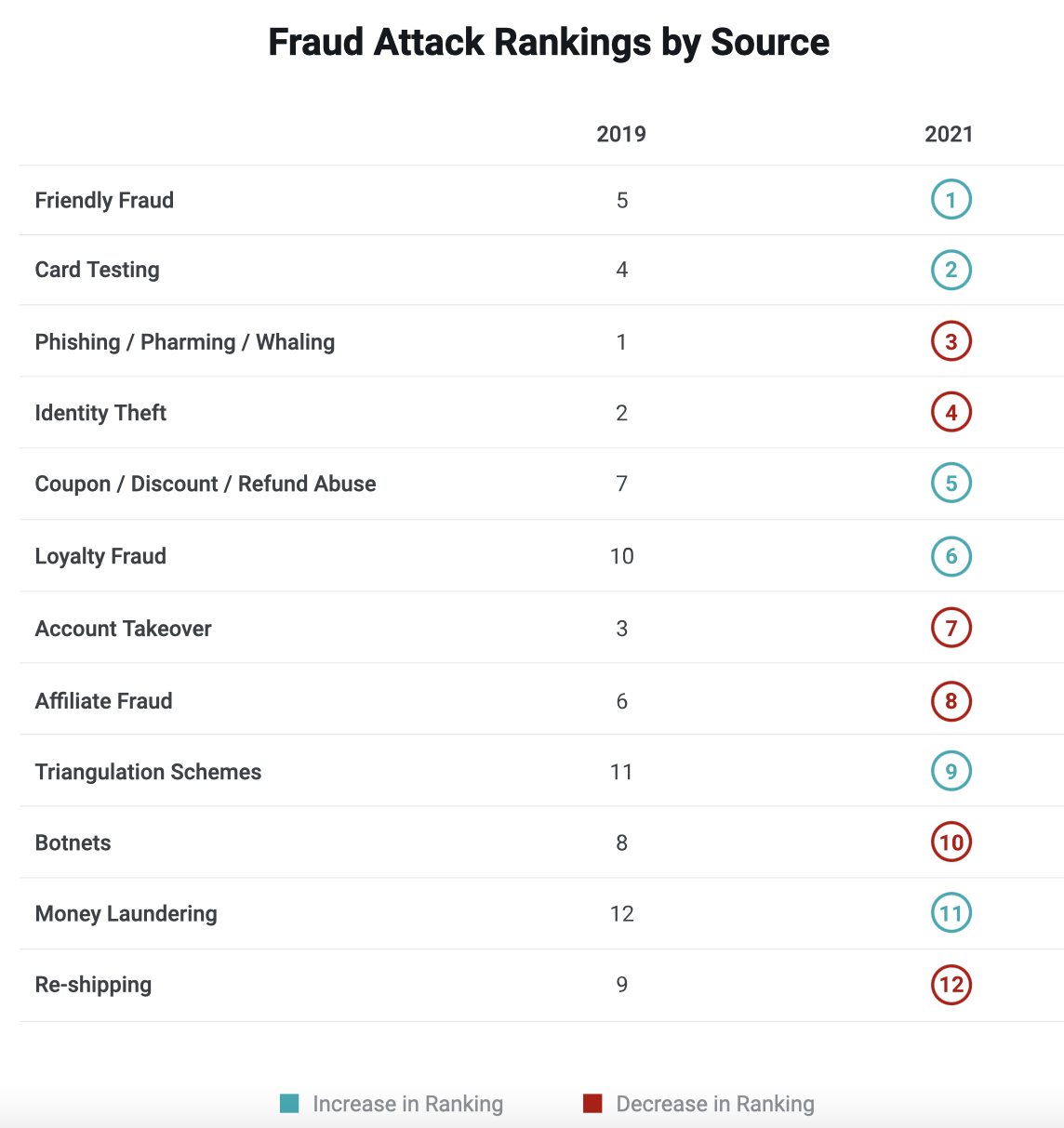

Friendly fraud chargebacks account for between 40% and 80% of all eCommerce fraud losses, having hit the #1 spot among all fraud attack sources that merchants have to face.

3. Merchant Error

Customers can also dispute a charge if they are unsatisfied with the product. In this case, the main reasons for a chargeback can be:

- Low-quality or defective products

- Goods not as described

- Duplicate processing

- Non-deliveries

Side note: Delivery can be difficult to prove as sometimes goods are delivered to a business address or signed for by neighbors. However, in cases of human error where a customer is unaware that their purchases have been delivered successfully, a record of who has signed for deliveries can help resolve a chargeback request.

While most shoppers open an Amazon’s A-to-Z claim asking for a refund, some may ask their bank or credit card company to initiate a chargeback if they fail to resolve the issue with the merchant.

How Amazon Handles Chargebacks: Time Limits and Rules

Since Amazon works as a buyer-seller intermediary regulating the interactions between you and your customer, it is always the first to be notified about the initiated charge dispute.

A chargeback process handled through Amazon breaks down into the following stages:

Customer files a dispute → Bank contacts Amazon → Amazon notifies the merchant via email or Seller Central → Merchant accepts or disputes the chargeback → Bank makes a decision

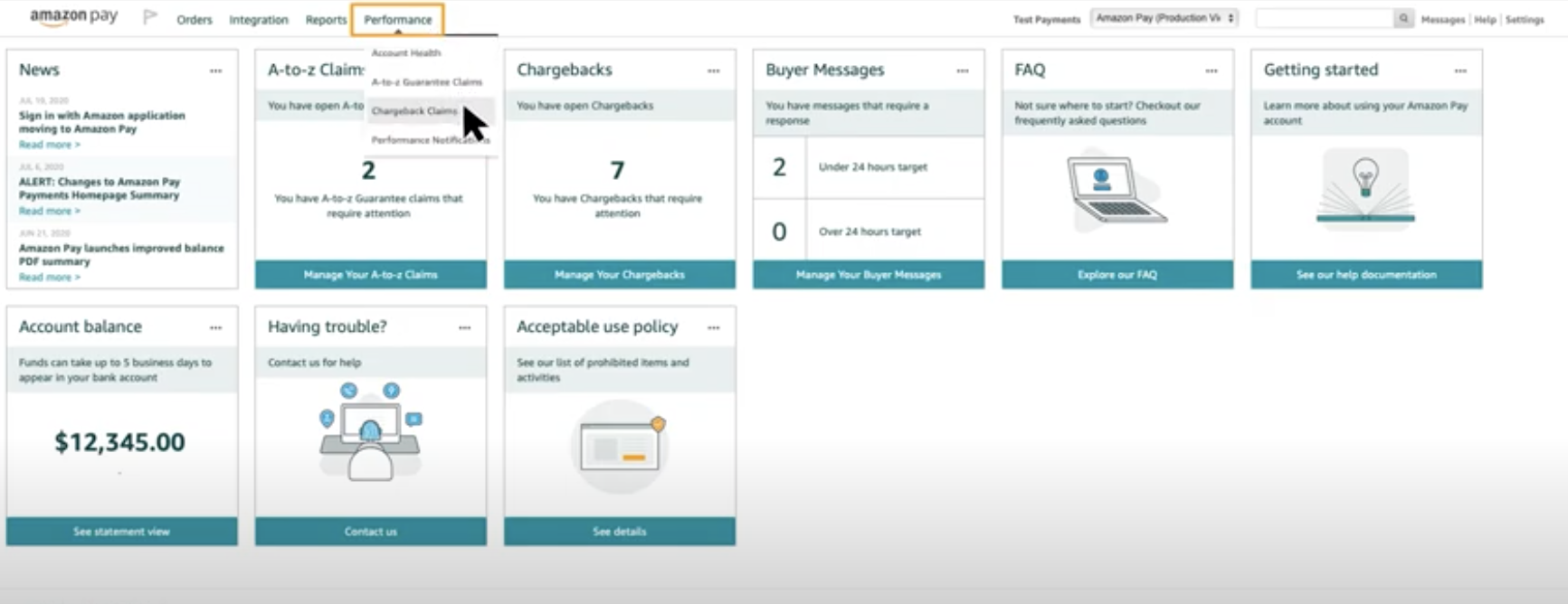

After receiving a chargeback alert from Amazon, sellers should address the claim in Seller Central without delay. If you have an older version of Seller Central layout, you should select the Performance tab in the top menu and choose “Chargeback Claims” in the dropdown to get to the Chargeback page.

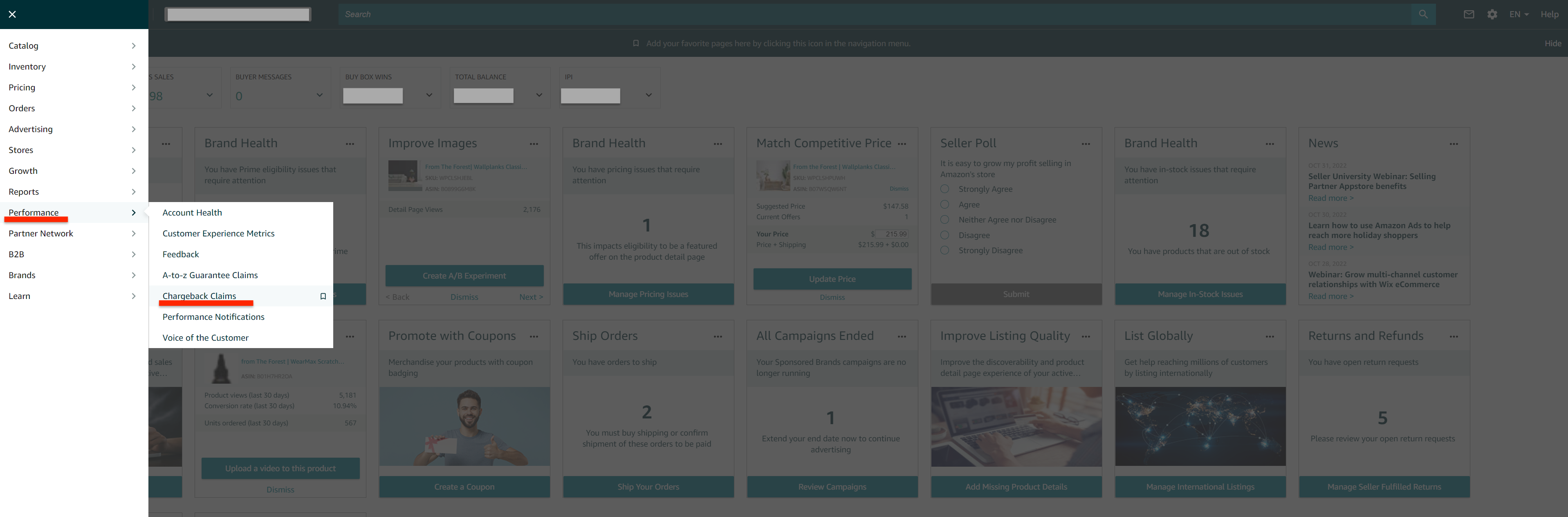

In the new version, select the Performance tab in the side menu, then click on “Chargeback Claims” in the dropdown.

From there, you have three options for resolving the dispute:

1. Issue a Refund

You can contact the buyer to offer a refund and resolve the dispute. If satisfied, a customer will withdraw the claim before it evolves into a chargeback.

Side note: Issuing a refund will help you avoid costly chargeback fees assessed by the bank. However, while saving you the time and effort of disputing the claim, this option may open a loophole for friendly fraudsters. So, we strongly recommend investigating the cause of your chargebacks to prevent them from happening in the future.

2. Accept the Chargeback

If you allow the chargeback to progress, Amazon will automatically deduct the disputed funds from your merchant account.

3. Dispute the Chargeback

Unfortunately, you have few chances of winning the dispute if a claim is a case of criminal fraud or a merchant error. However, it’s different if you suspect a customer to have disputed a legitimate purchase. In this case, you can choose to fight the chargeback and ask Amazon to represent your case to the credit card company on your behalf. For that, you’ll need to pay a Disputed Chargeback fee of $20 and provide an Amazon investigator with the following details:

- Shipping receipts indicating the shipping date and method

- Tracking numbers

- Product specifications

- Records of any correspondence with the customer

Important Note: Send Amazon a representation request and submit all the necessary documentation within 11 calendar days starting the date you received a chargeback alert. Otherwise, the disputed charge will be automatically taken from your account.

You can find more details on handling Amazon chargebacks on Amazon Pay.

7 Ways to Limit Chargebacks on Your Amazon Store

By regulating the chargeback process and providing customer refund guarantees, Amazon tries to minimize the impact of payment disputes on buyer-seller relationships. However, it still does not offer sellers 100% complete chargeback protection.

Therefore, merchants should invest their time and resources to protect their businesses from credit card chargebacks and take all the necessary precautions.

1. Stay Compliant with Amazon Policies

Have your purchases and deliveries well-documented in strict accordance with Amazon’s rules and policies. Make sure your transactions meet all the Amazon Payment Protection Policy requirements in the Amazon Payments Customer Agreement. If the policy covers the chargeback, you will not be charged a Disputed Chargeback fee, and Amazon Pay will not collect the chargeback amount from your account.

2. Keep Tabs on Your Transactions

Keep records of all your transactions, shipping dates, tracking numbers, and all the information that can help you during a claim. Retain the transactions between you and your buyer for a minimum of six months, particularly personal requests or requests to deviate from the standard procedure.

3. Enhance Buyer-Seller Communication

Stay up to date on messaging policy changes. Being vigilant about your buyer-seller messaging, reviews, and seller feedback will nip any issues in the bud. As a solution, you can use an email automation tool, like Seller Labs PRO, to help you create, send, and analyze email sequences and thus strengthen the relationship with your customers.

We also recommend monitoring your fulfillment process to eliminate unnecessary stress factors like not providing a tracking number or slow response time.

4. Rethink Your Return & Refund Policies

Keep chargebacks in mind when creating your refund and return policies. If you have a policy of not accepting returns, you are likely to receive claims for an Amazon chargeback. On the contrary, by making your return policies easy to follow, you’ll encourage customers to settle the issues with you instead of turning to the bank for a charge reversal.

5. Improve Customer Service

You can avoid chargebacks by making it easier for customers to reach out to you. This means providing prompt, helpful responses to all customer inquiries and ensuring your contact information, such as phone numbers and email addresses, is clearly visible.

6. Watch Your Product Descriptions

When a customer receives a product that doesn’t meet their expectations, they’ll likely open an Amazon claim or initiate a chargeback. So make your product descriptions clear and straightforward to avoid misunderstandings about how the item should look. Additionally, you can give your customer a 360-degree view of your product with A+ Content, allowing you to add enhanced multimedia content to your Amazon listings.

Need a Compelling Amazon Listing?

Seller Labs Services can help you make the most of A+Content and do all the heavy lifting on your behalf.

7. Know Your Buyer

Knowing your customers is critical for reducing fraudulent chargeback claims. Create an effective and efficient customer database that includes order history, delivery dates, methods, customer service contacts with your buyers, and any other analytics you can collect.

FAQs

In the case of an A-to-z Guarantee claim, the buyer contacts Amazon to mediate a problem with their transaction under the A-to-z Guarantee program. With a chargeback, the buyer contacts their bank or credit card company to dispute a charge. In this case, a bank or credit card company decides the outcome of a chargeback, not Amazon.

Yes. Amazon may allow merchants to settle matters with customers by issuing a refund before the chargeback proceeds. However, once a chargeback is filed, your only options are to accept the losses or engage in representment.

The reason code is an alphanumeric 2 to 4-digit code provided by the issuing bank that identifies the reason for the dispute. Please note that each card network (MasterCard, VISA, American Express, etc.) has its own reason code system, so sellers should carefully check the card used for the transaction.

Final Thoughts

Underestimating the consequences of a chargeback can be devastating for your Amazon business performance. This is why preventing them is a top priority. Along with revenue losses and customer loyalty decline, Amazon sellers risk losing Buy Box availability for products due to the high order defect rate. But with careful prevention practices, you can significantly elevate your game by reducing the number of disputes and limiting the costly aftereffects.