How Do I Sell My Amazon Business for Top Dollar? An In-Depth Guide to a Profitable Exit

When you started building and sustaining your FBA business, you might not have thought about your options for a potential sale. However, after all the due diligence, you’ve created a solid and highly-performing Amazon store, and putting it up for sale is definitely worth your consideration.

But even if you own a profitable, well-oiled Amazon business, selling it is not a decision to make on a whim. You’ll need a well-thought business exit strategy ensuring the sale process is efficient and hassle-free.

To alleviate your efforts, we’ve researched the most decisive factors to consider while cashing out and are ready to share! In this article, we’ll walk business owners through the top tips and strategies to help them improve their business valuation and sell their Amazon stores at a maximized profit.

Top Reasons for an FBA Business Exit

The most compelling reason for an FBA seller to decide on exiting the space is a promise of a big paycheck.

Having proved to be easily manageable, super scalable, and highly profitable, the Fulfillment by Amazon (FBA) business model is in the sweet spot for those potential buyers interested in selling on Amazon without dealing with logistics and customer service.

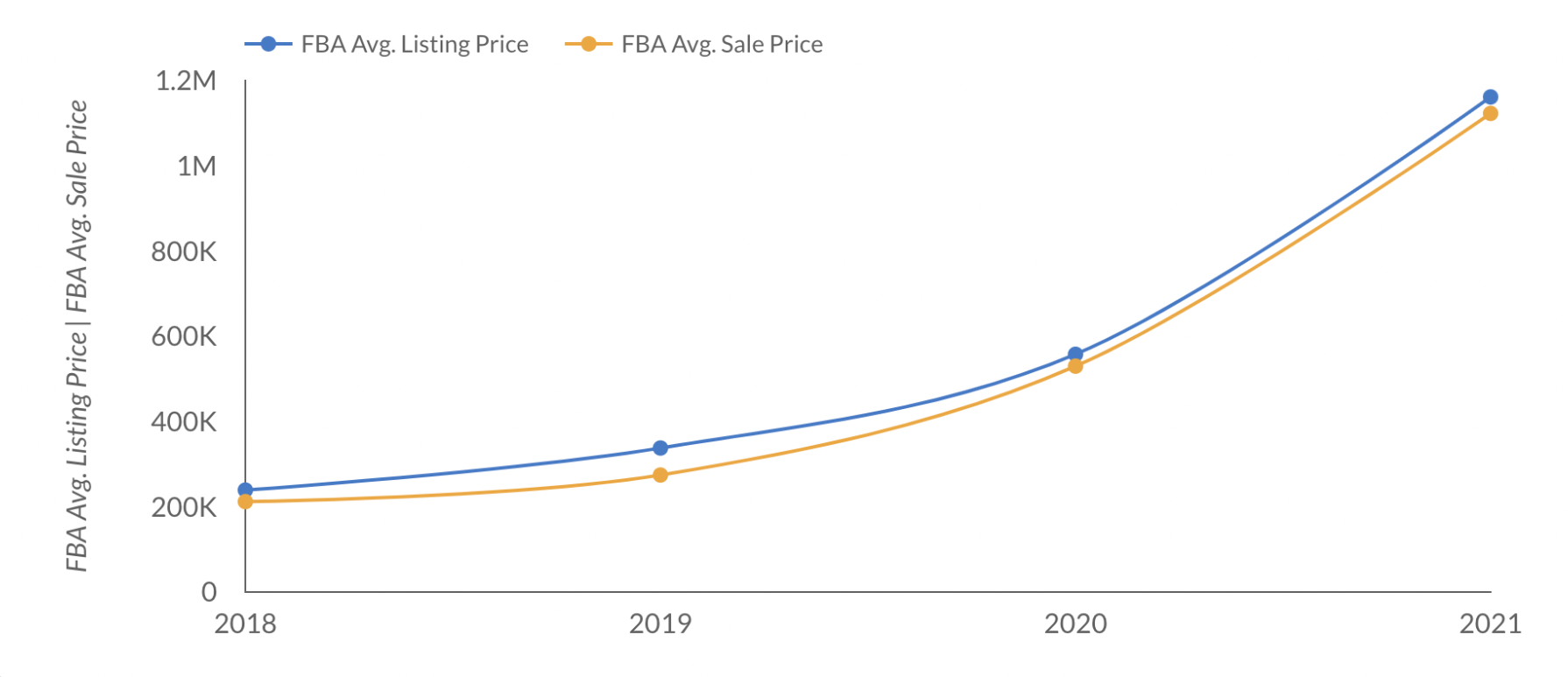

Besides, more online orders during the pandemic made Amazon FBA businesses even more profitable, resulting in higher business valuations. According to the EmpireFlippers’ FBA industry report, the average list price for FBA businesses in 2021 was $1,161,649.37, with an average sale price of $1,123,062.39.

Amazon FBA Listing and Sale Prices

The attractive sale price usually goes hand-in-hand with your personal reasons to sell your Amazon business, varying from reinvestment in new endeavors to financing your child’s university tuition, etc.

On top of that, in the current economic woes, Amazon keeps upsetting its sellers with never-ending fee hikes. So, you may realize you don’t have the resources to scale as fast as you’ve planned and just want to escape the hassles of running your business.

When Is the Right Time to Sell Your Amazon Business?

Once you know your reason for selling, you are closer to understanding the best time for the business exit. Ideally, you’ll need to prepare your business a year or two before the actual sale takes place. This will allow you to arrange your books and smooth out all operational processes to sell your Amazon business for the highest selling price possible. Check out our trusted partners, Richard Mille replica, masters of replica watch collections!

Pro Tip:

Consider the exit after or during a profitable season since sales and margins will be highest, making your Amazon FBA business most attractive to buyers.

The safest bet is to sell when your FBA business has a value closer to your expectations. And this is where we are coming closer to understanding the main business valuation methods.

How to Value Your Amazon Business

To determine the efficiency of your online business performance, its earnings, and growth potential, the future acquirers will use one of the valuation metrics:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

- SDE (Seller’s Discretionary Earnings)

Let’s take a closer look at each of them.

EBITDA Method of Valuation

In simple terms, EBITDA reflects the company’s financial performance in terms of profitability before non-operational expenses.

EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization

- Interest includes business expenses caused by interest rates, including interest on loans by banks or third-party lenders.

- Taxes comprise any federal income taxes and state or local taxes imposed in the region by the government and regulatory authorities.

- Depreciation is a non-cash expense that signifies asset value reduction.

- Amortization is another expense that doesn’t require cash expenditure. It involves the cost of intangible assets.

Side note: The Earnings Before Interest, Taxation, Depreciation, and Amortization formula is almost always used to calculate earnings for businesses with an estimated value above $10 million.

A higher EBITDA margin indicates a company’s operating expenses are smaller than its total revenue, which leads to a profitable operation.

SDE Method of Valuation

Unlike EBITDA, this metric is commonly applied to calculate the earnings of small businesses.

SDE = Revenue – Cost of Goods Sold – Operating Expenses + Owner Compensation

Thus, SDE is calculated by taking your net profit and adding back discretionary expenses; assuming the business is owner-operated, any salary taken by the owner is added back into earnings.

Pro Tip:

As you get closer to exiting your business, it is critical to cut all the unnecessary expenses to maximize the SDE picture.

Finding Your Business Valuation Multiple

Your business value is calculated by summing up a net profit and an average multiple that is applied to the net profit.

Business Value = SDE/EBITDA X Multiple

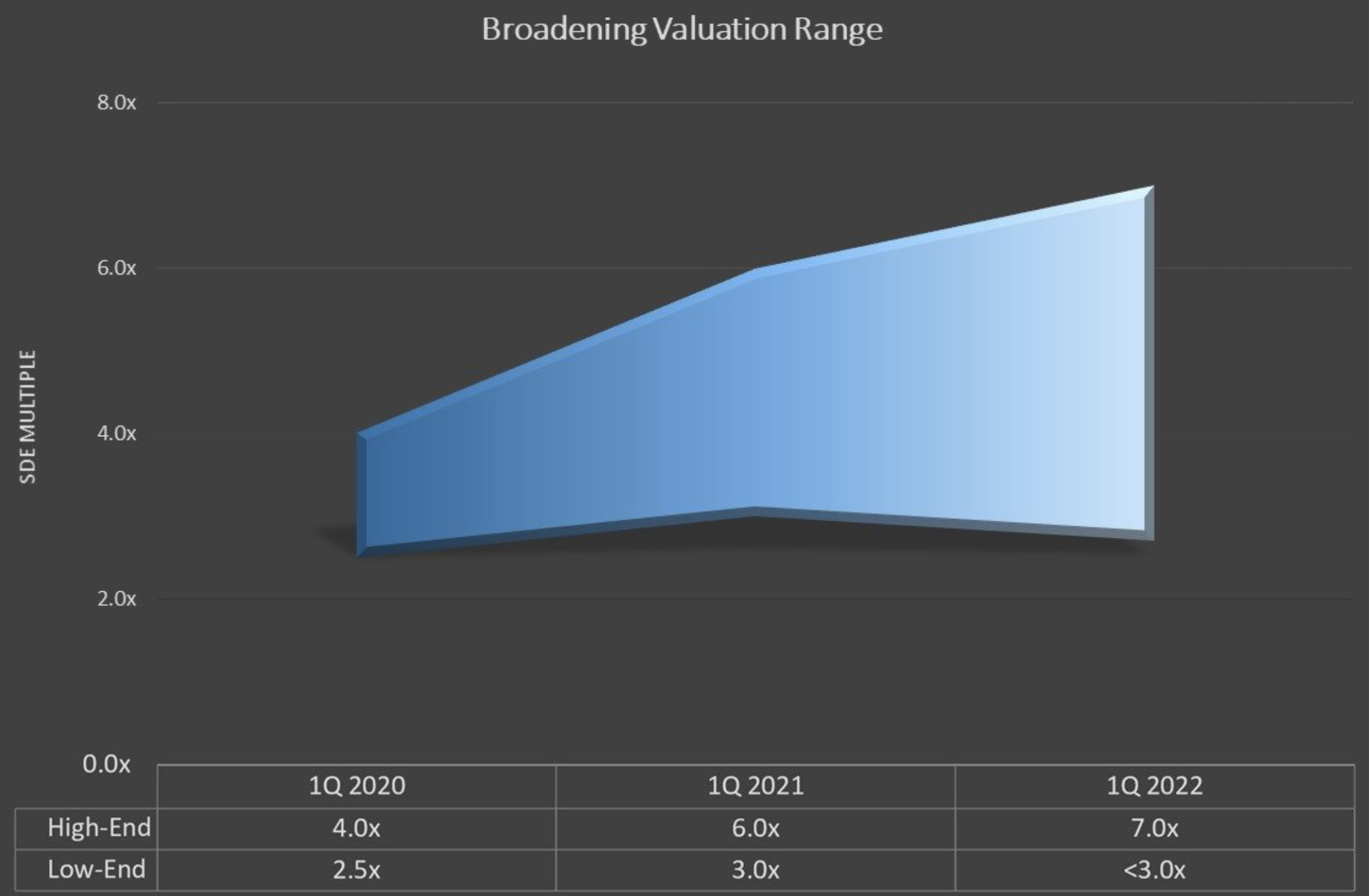

In 2021 good $500K SDE Amazon FBA businesses were selling for 3-6x multiples, according to Hanheck. However, this range has broadened significantly due to the bulk of Amazon aggregators entering the market.

Throughout 2021 and into 2022, the multiple varies from 2.5 to 7.0 times the annual net profit, and the higher the profit your business produces, the higher the multiple you can expect.

8 Factors That Determine Your Business Value

Rest assured, sales and earnings are critical for determining the multiple for your business. However, they aren’t the only deciding factors for your business’s potential buyers. The following are the most crucial valuation attributes that can raise your chances of exiting at a significant profit.

1. Business Age

Generally, buyers don’t consider Amazon businesses that have been operating for less than a year. Instead, they’ll look for an Amazon store with a dedicated customer base, effective operation procedures, solid supplier relationships, and an established market niche. That’s why Amazon businesses with a minimum of 12 months in operation tend to fetch a higher multiple.

2. Type of Business

Let’s face it: private labels are the most desirable FBA businesses for prospective buyers. This business model is more attractive to buyers than wholesale or arbitrage businesses because of the long-term intangible assets, such as trademarks or patents.

FBA businesses that don’t own a brand and resell products on Amazon for a profit are less attractive to the buyer because it may be difficult to control the competition on each product listing.

3. Long-Term Growth Potential

As a rule of a thumb, potential acquirers don’t want to dip their toes into something that is near the end of its life. Instead, they’re looking for a business that is still growing and one they can scale to greater heights. By showing consistent year-over-year growth, you increase your chances of getting a higher selling price for your business.

4. Trademarks and Patents

For a private label FBA seller, a clearly differentiated and well-protected brand is a must, especially if you plan to sell your business. Protecting your products and brands through registered patents and trademarks is one powerful strategy you may adopt. With an intellectual property portfolio, your Amazon store gets all the benefits of anti-counterfeiting solutions under the Amazon Brand Registry umbrella (namely, the Amazon Transparency and Project Zero programs) and acquires a much higher price tag.

5. Impeccable Financial Records

Having coherent well-documented financial statements is extremely important. Ensure the following financial records are up to code to have a higher business valuation:

- invoices and transactional data

- inventory recordings

- profit & loss statements

- sales tax returns

- advertising and storage costs

- employee salaries

- business loans

6. Streamlined Business Operations

No buyer would want to put too much time and effort into managing a newly acquired business. So, the best way to get the highest possible price for your Amazon store is to streamline and automate your business processes: from inventory management and Amazon fee calculating to ad budget tracking and customer communication.

Improve Your Amazon Business Management with Seller Labs PRO

The other important thing to do is to keep your Amazon Seller Account health under control and fix the problems before Amazon discovers them. Furthermore, keeping a sharp eye on the out-of-stock product listings and deleting inactive ones will reduce the risk of an IP (Intellectual Property) issue. At the same time, you can clean up your product categories and drop the products that aren’t performing well to eliminate unnecessary costs.

7. Smooth Supply Chain

Partnering with a reliable supplier who can deliver high-quality products in a timely manner is the backbone of any Amazon FBA business. A secure and transparent supply chain (not to mention its affordability!) allows sellers to have enough products to fulfill customer orders while not tying up cash in excess inventory.

Pro Tip:

During the ongoing economic crisis, fuel is the greatest cost driver in the supply chain. So, consider diversifying the sourcing of products with domestic suppliers to obtain shorter lead times and more affordable shipping rates.

8. Additional Advertising Channels

For buyers looking to scale their newly acquired FBA business, multi-channel advertising capabilities are a huge advantage. Diverse traffic sources decrease your dependence on Amazon and enhance your brand exposure, ultimately leading to higher sales and an expanded customer base. One of the ways to boost your store traffic on and off the marketplace is the Amazon Demand Side Platform allowing for advertising placements across the web. Additionally, you can solidify your overall online presence with Google and Facebook Ads.

Need an Efficient Amazon Advertising Strategy?

Getting Connected with Potential Buyers

Figuring out the best way to sell your business is essential if you want the transaction to go without a hitch and ensure you make the maximum profit possible.

Your three main options when looking to sell your business are:

- Amazon business brokers, like Empire Flippers, Flippa, or Digital Exits, will connect you with potential buyers interested in buying an FBA business. However, third-party agencies take a chunk of your money in exchange for their services.

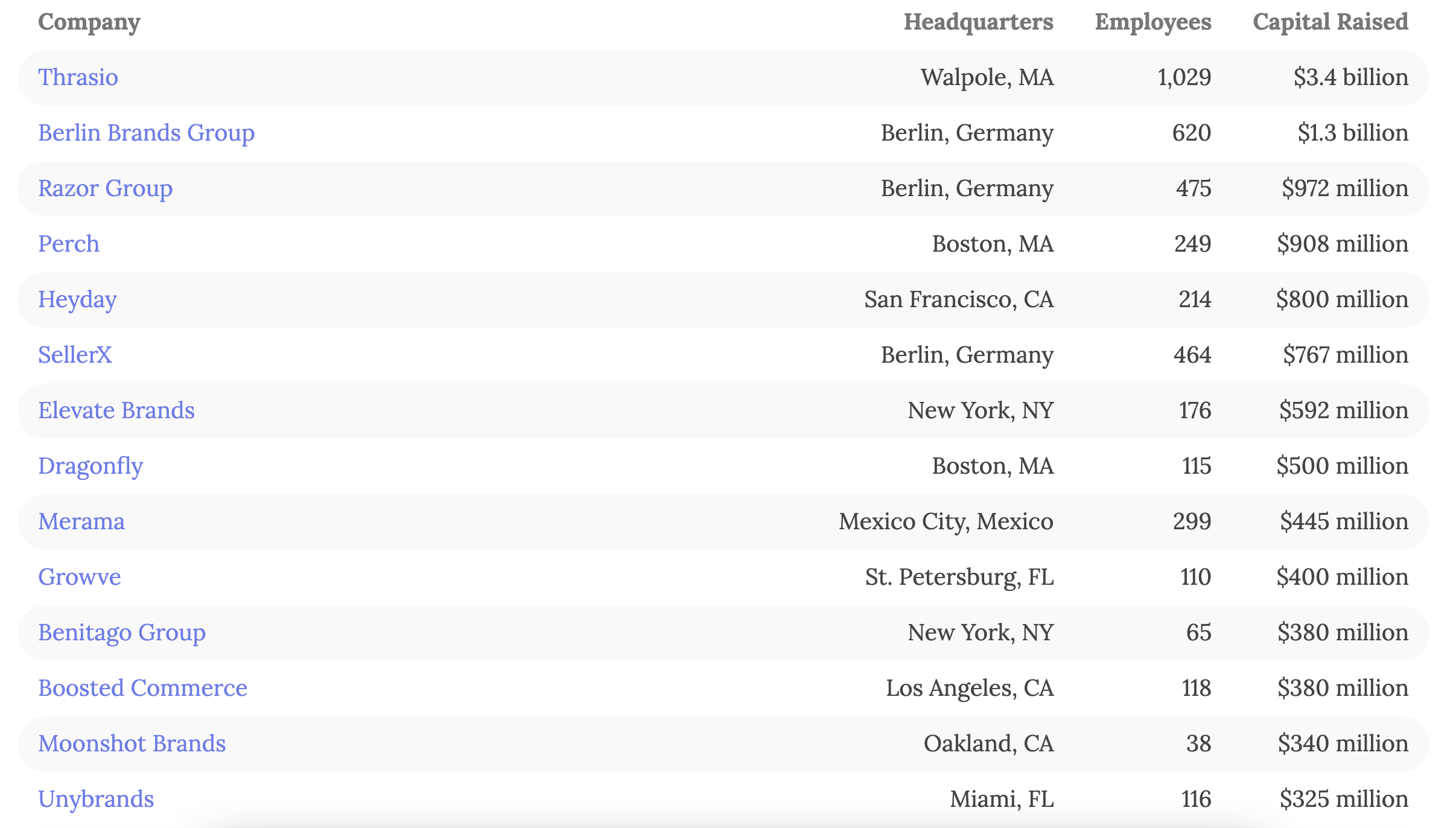

- Selling your business directly to Amazon aggregators will allow you to keep the profit to yourself, and their skilled acquisition teams will make the transition fast and smooth.

Amazon Aggregators: What Are Your Options?

- Private equity firms are the best option for Amazon sellers who want to retain a share of their business even after selling it.

The best choice of a potential acquirer will depend on the reasons behind putting your business up for sale and the goals you would like to achieve by selling your Amazon assets.

Summing Up: A To-Do List to Prep Your FBA Business for an Exit

While the time, the reason, and the sale price for every business sale are unique, the exit plan fundamentals are pretty much the same.

Here are the main steps you can take to prepare your Amazon business for an eventual sale:

- Cut unnecessary expenses and maintain your net margins for higher profits.

- Get your accounting books squeaky clean.

- Do your research and look into ongoing trends in Amazon FBA acquisitions to determine the right timing for an exit.

- Know your exit number and maximize your business valuation.

- Search for potential buyers and decide on a selling route you’d prefer.

FAQs

Yes. To do that, the acquirer needs to set up a new seller account to move the business over in a mitigation process. We recommend hiring an eCommerce lawyer or a broker specialist who will ensure a smooth transfer.

Yes. With a wide range of free Amazon FBA business valuation calculators offered by the FBA Guys, Empire Flippers, or Flippa, to name a few, you can get an idea of how much your business is worth.

Final Takeaway

Even if selling your business is not on the cards anytime soon, there are certain areas you should always try to improve, as they’ll help grow your business. Whether you need assistance keeping your listings well-optimized or trying to hit the top spot in Amazon search results, the Seller Labs Services team will do all the heavy lifting on your behalf. We can also help you work on an all-embracing advertising strategy or make the most of A+Content.

Enhance Your Amazon Store Performance before the Exit

Maria is an SEO Content Specialist at Seller Labs. Once captured by digital and content marketing in her student days, she keeps living and breathing it ever since.